Sep 9 2020

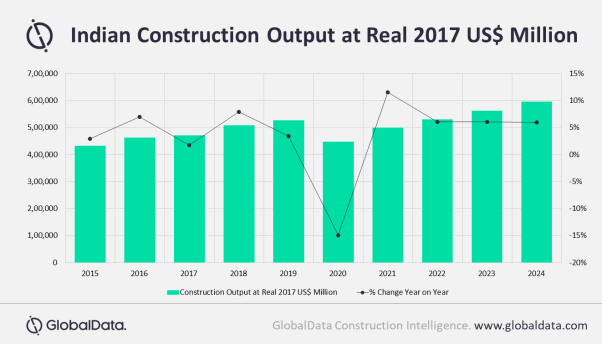

Driven by the unprecedented contraction of 50.3% in real terms in Q2, the Indian construction industry is expected to shrink by 14.9% in 2020. However, despite the prevailing gloomy situation, the industry is expected to post a sharp rebound and grow by 11.6% in 2021, owing to lower base and pent up demand, says GlobalData, a leading data and analytics company.

Growth will also be driven by investments in the National Infrastructure Plan, the newly-announced Affordable Rental Housing Complex (ARHC) scheme and investments in the industrial segment due to Indian government’s push towards ‘Atmanirbhar Bharat’, which aims to reduce imports and make the country self-reliant. The industrial construction sector would also likely benefit from the global shifting of supply lines from China, with the Indian market offering benefits such as large captive market and low cost labor.

Moreover, the lifting of lockdown has resulted in the virus outbreak spreading at a record pace in the country, with India now emerging as the latest epicenter for COVID-19.

As a result, construction activities continue to remain disrupted with labor shortage at project sites exacerbating the situation for the private sector which are already grappling with multiple problems such as liquidity crisis, rising project costs and lower demands.

Dhananjay Sharma, Construction Analyst at GlobalData, comments: “The industry is expected to remain subdued for the remaining part of the year as the COVID-19 situation continues to worsen across most of the country, thereby adversely affecting the industry from both supply and demand side.”

The public sector, which accounts for much of the investments in the infrastructure segment, including in electricity, water and sewage utilities, is constrained by a widening fiscal deficit situation due to lower revenues and higher social expenditure during the crisis.

The federal fiscal deficit in the first four months of the current financial year has already reached 103% of the budgeted target for financial year 2021 (Apr-March), with the full year fiscal deficit now expected to cross 7.5% of the GDP from the earlier 3.5% of GDP. Moreover, due to the lower revenue generation and higher expenditure, the debt to GDP ratio is expected to rise from 70% in FY 2020 to more than 80% in 2021 as per market consensus.

Sharma concludes: “On the private side, investment in hotels, restaurants, malls, theatres and cinema halls, offices, and educational buildings is likely to suffer in the short-term as these sectors have been heavily affected by the COVID-19 crisis. Additionally, higher unemployment and the uncertain economic condition are leading to people postponing their housing needs, which would also affect the residential market.”