Oct 26 2015

Mountain Valley Pipeline, LLC, today, formally applied to the Federal Energy Regulatory Commission for authorization to build a 301-mile interstate natural gas transmission pipeline designed to provide timely, cost-effective access to the growing demand for natural gas for use by local distribution companies, industrial users, and power generation facilities in the Mid-Atlantic, Southeast, and Appalachian regions of the United States.

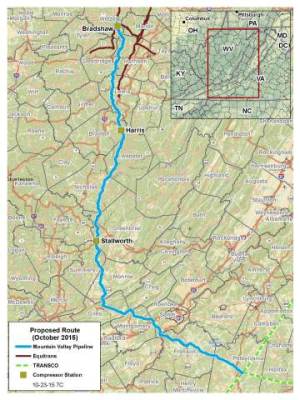

Mountain Valley Pipeline Proposed Route October 23, 2015 (Graphic: Business Wire)

Mountain Valley Pipeline Proposed Route October 23, 2015 (Graphic: Business Wire)

Mountain Valley Pipeline, LLC is a joint venture between EQT Midstream Partners, LP (NYSE:EQM), majority owner and operator of the proposed Mountain Valley Pipeline; and affiliates of NextEra Energy, Inc. (NYSE:NEE); WGL Holdings, Inc. (NYSE:WGL); Vega Energy Partners, Ltd; and RGC Resources, Inc. (NASDAQ:RGCO). The Mountain Valley Pipeline (MVP or Project) would transport the abundant supply of Marcellus and Utica natural gas - commencing in Wetzel County, WV and traversing south through 11 counties in WV; and southeast through six counties in VA before ending in Pittsylvania County, VA. The MVP is expected to provide at least 2 Bcf per day of firm transmission capacity; and pending regulatory approval, construction is anticipated to begin in late 2016, with a full in-service targeted for the fourth quarter 2018.

Through this certificate application filing, the Federal Energy Regulatory Commission (FERC) is being asked to certify the public convenience and necessity of the MVP project. The FERC, together with several cooperating agencies, will conduct a detailed review and evaluation of a broad number of subjects, including public safety; water resources; karst topography; air quality; wildlife, soils, and vegetation; protected species; cultural and historic resources; sound levels; realistic alternatives; and cumulative economic benefits.

On October 31, 2014, the FERC granted authorization to begin the pre-filing process for the MVP project. During the past year, the MVP team has conducted 16 open houses, in addition to the six scoping meetings hosted by the FERC, all aimed at encouraging an open dialogue with community members, landowners, and public agencies in order to receive comments and feedback on the MVP project.

The certificate application is a collection of information gathered before and during the FERC pre-filing process. This comprehensive set of documentation includes extensive research from environmental, geological, and economic studies conducted by the MVP project team and outside experts – and perhaps more importantly includes intelligence learned during discussions with landowners along the route and local elected officials.

The MVP project team considered more than 1,000 miles of alternatives and variations to the proposed route, and made numerous minor adjustments for individual property owners along the route, in order to mitigate concerns that were raised during the pre-filing process. The proposed route identified in the application encompasses these various revisions, which include the protection of streams, wetlands, and cultural resources, as well as the avoidance of or modification to several sensitive areas and karst topography regions. Examples of such adjustments include:

- Reduction in permanent right-of-way width from 75' to 50'

- Avoidance of the Spring Hollow Reservoir and Camp Roanoke areas

- Avoidance of the Elk River Wildlife Management Area

- Alteration to the Blue Ridge Parkway crossing in order to minimize vegetation clearing and long-term visual impact

- Avoidance of Cahas Mountain Rural Historic District and the Town of Boones Mill’s water source treatment plant

- Avoidance of the Burnsville Lake Wildlife Management Area

- Proposed number of compressor stations during construction reduced to three

"Filing of the formal application is a milestone for MVP and we thank the many landowners, elected officials, and community members who have worked with us to design a proposed route that takes into account a multitude of individual requests and environmental considerations,” stated Randy Crawford, chief operating officer, EQT Midstream Partners. “Since the Project’s inception, we have been committed to listening, learning, and continuing an open dialogue. We will preserve this same attention to detail as the Project progresses; and we will maintain our diligent focus on building a world-class pipeline.”

One of the Project’s primary objectives is to serve communities along the route. The working partnership with Roanoke Gas Company, who will be a shipper, is designed to supply and potentially expand the Roanoke Gas customer base throughout southwest Virginia. Additionally, markets in the area that presently do not have natural gas service will have the ability to access the MVP, which in turn is expected to attract manufacturing opportunities to the area. It is clear that having a safe, reliable source of natural gas is important to secure industry growth, which subsequently will stimulate job creation and spending throughout the region.

Joyce Waugh, President, Roanoke Regional Chamber of Commerce, stated, “The Roanoke Regional Chamber supports the continued development of infrastructure that is integral to business expansion in our region. Our prosperity depends on the presence of robust transportation – education – recreation – healthcare – telecommunication – and energy infrastructure. With these building blocks in place, our economy and our quality of life are given great opportunities for growth.

“As a result of this philosophy, the Roanoke Regional Chamber supports the Mountain Valley Pipeline project and strongly encourages its development in accordance with laws and regulations of the United States and the Commonwealth of Virginia; in cooperation with property owners; with the utmost safety; and with respect for the environment and our region’s beauty,” Waugh continued.

Steve Roberts, President of the West Virginia Chamber of Commerce provided a similar endorsement, stating, “Having access to a reliable, cost-efficient source of natural gas is essential for growth and progress in any region of the United States. Over the long-term, the Mountain Valley Pipeline project will not only generate significant tax revenues for counties to fund local schools, roads and other important priorities of county government; but it will also serve as a magnet for manufacturers and other economic development opportunities for our various West Virginia communities along the route.”

From an economic benefits perspective, the MVP project is expected to bring significant and meaningful benefits to West Virginia and Virginia, and the counties along its route, based on findings from FTI Consulting, the company that managed and produced the MVP economic benefits report. FTI took a conservative and reasonable approach to estimating the state-level impacts related to the MVP – utilizing cost data for MVP’s in-state spending for goods and services only and excluding spending related to out-of-state goods and services. The MVP project estimates:

- Spending of $811 million in WV and $407 million in VA on labor, equipment, materials, and services

- Employment support at the peak of construction of more than 4,500 jobs in WV and 4,400 jobs in VA, including direct, indirect, and induced jobs

- Direct employment will generate more than $335 million in labor income in WV and more than $165 million in VA during construction

Increased state tax revenue is also a significant factor related to the MVP project. For county level tax benefits, FTI discussed the process of estimating annual pipeline property (ad valorem) taxes with WV and VA state tax officials in order to be consistent with how the states would determine the property taxes owed by MVP. For state-level tax benefits, FTI estimated taxes based on historical state tax revenues and the sources for those revenues. The state tax analysis reflects taxes generated mainly from one-time construction and commissioning spending.

- Annual MVP ad valorem taxes for WV are estimated at almost $17 million once the pipeline is operational, and more than $7 million in VA

- Estimated state and local tax revenues generated during construction are more than $47 million in WV and more than $34 million in VA (sales, use, income, property, and other tax categories)