The Conference Board of Canada, in its report titled ‘Summer 2012 Outlook for the Industry’, has predicted a decline in the growth of residential construction industry. The growth pace which was brisk during the beginning of 2012 is expected to reduce in the second-half of 2012 and extend into 2013.

In addition to this slowdown, the residential construction industry has to also gear up to adapt itself to the strict mortgage lending rules to be brought into force in 2013. The most affected part of the industry due to the expected decline in growth will be the multiples segment, as a large number of units still remain unoccupied. The other factors that will act as a dampener to the growth of the residential construction industry include increased household debts, low levels of consumer confidence, and moderate growth in income and jobs.

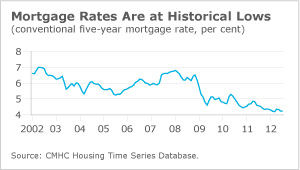

Due to an increase by 23% in multiple-unit construction, there was a 15% surge in housing starts during the first half of 2012. A 7.3% decline in housing starts has been predicted in 2013. Toronto and Vancouver are among the places to feel the worst impact. The residential construction industry continues to remain healthy in spite of all these challenges. Indications of low mortgage delinquency rates and borrowing amounts being on par with property cost are proof that Canadians can effectively manage their mortgage debts.

Director of Industrial Economic Trends, Michael Burt, said that a soft landing has been predicted for the residential construction market, and this means that the post-recession growth in Canada will not be fuelled by the residential market any longer. He also said that 2013 appears bleak as industry profits and housing starts are expected to decline.

Source: http://www.conferenceboard.ca